There are plenty of ways to investing in mutual funds. But before you do so, you need to know abour ‘Direct plans of mutual funds’ and how they make such a big difference.

If you’re wondering why you’re seeing so many ads from mutual fund investing platforms like @scripbox and such on your social media feeds, allow me to throw some light.

These platforms are mutual fund distribution agencies. Middlemen of sorts. And they make anything from 1 to 2% as commissions. Some of them never mention the fact that they make commissions. Some do.

But the problem either way, is that they make these numbers sound insignificant.

It’s just a measly 1-2%.

It does sound small. It’s easy to shrug it off. And several do.

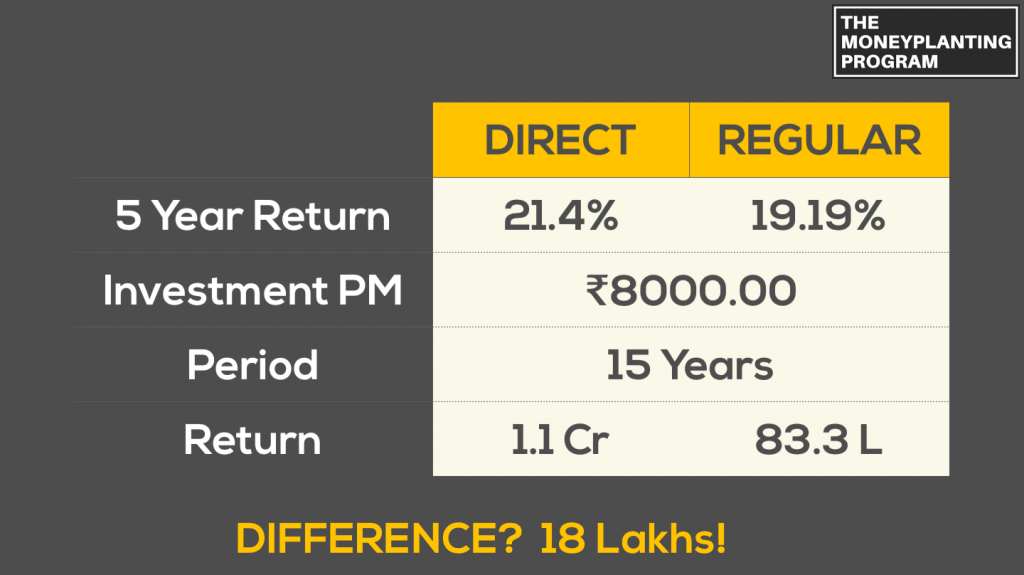

But here’s some simple math.

- Assume you invest 15,000/- per month for the next 20 years, and your mutual fund returns an average of 14% per year.

If you invest through these middlemen, you would eventually end up with 1,97,45194/- (About 1 Crore, 97 Lakhs) - But, if you bypass these middlemen and invest directly, you’d make 1% more. Applied over the entire timeframe, that would translate to 2,27,39,325/- (About 2 Crores, 27 Lakhs)

That 1% made a difference of over 30 LAKHS.

Basically, you’d lose a non-trivial 30 Lakhs, since a middleman was involved.

As a matter of fact, if you are a prudent 25-year old, and end up investing 15,000/- per month until the age of 60, you would lose a mind-numbing 5.5 Crores to commissions!

1% seem small still?

In reality, the difference between the returns of commission-based and commission-free mutual funds is often far higher than 1%, with some even exhibiting more than a 2% difference.You can only imagine now how much of an impact that would make.

So what happened to this money when investing in mutual funds?

Where did it disappear? And how was someone able to take it away from you, right from under your nose? You’re a smart cookie after all.

Well, the middleman took it. Call them whatever you want – agents, distributors, advisors, middlemen. And these commissions are rolled into a mutual fund’s NAV. So, many investors never even realize that they are losing money.

In the financial year 2018, mutual distributors made an astounding 8,500 Crores in commissions.

These list of such middlemen and the commissions they’ve earned is declared each year by the Association of Mutual Funds in India; or AMFI. And those reports can be found here.

This is why platforms like Scripbox and the like allow you to use their portals for free. But nothing comes for free. There is always a price to pay. The price in this case, is all that wealth you lost.

I’ve met several investors, even those who have been investing for over 10 years, who were never really aware that there has been a direct way to invest in mutual funds since 2013.

The ones who are aware that commissions exist, continue to assume that 1-2% is measly. So they let it be, never realizing how these small percentages chip away at wealth, in a significant way.

The returns of these no-commission products are higher, since no middlemen are involved. Consequently, no middleman has any benefit in promoting them. More than 98% of financial advisors in India are commission agents, and they too almost never mention these to their clients. So the burden of discovering their incredible impact, is left purely to an investor’s curiosity.

At the end of the day though, commissions are necessary. Without commissions, products don’t reach the masses.

But why lose so much wealth to commissions when you could easily bypass them? The system is designed so that the more educated investors can bypass them. So the question is, on which side do you want to be? There’s a clear winning side, and a clear losing side.

But here’s where the problem gets worse.

Quite a few of these middlemen platforms, have started masquerading as financial education providers. They conduct workshops and corporate financial literacy programs, and often for free. And a lot of folks who manage their organization’s training needs, fall for the pitch quite easily.

Completely free financial wellness workshops for all our employees. What’s to lose?

I have no qualms against someone trying to spread financial literacy. India needs it. But it gets a little twisted when organizations with self-serving interests do this. There is huge amounts of money to be made off your, and your people’s investments. And due to this very nature, their workshops hide a ton of useful facts and practices.

They may not insist that you use their platforms, but they will neither showcase other competing platforms which are better, nor educate on the dozens of ways people could invest directly, by-passing those commission costs altogether.

They may defend themselves in several ways.

We provide valuable add-on services like free workshops, single window access and handpicked, algorithmically selected mutual fund recommendations.

The problem with that argument, is that there are plenty of platforms which offer commission-free products and provide equally good recommendations. And between you and me, selecting mutual funds isn’t rocket science. It’s a skill which can easily be learnt. It’s just never been taught.

At the end of the day, Education needs to be impartial, unbiased, comprehensive.

Else it isn’t really education. Its propaganda.

So what can you do?

It is incredibly hard for anyone in the financial service industry to not become a part of the system. The lure of commissions is very powerful. My earlier post on this also highlighted the study by Harvard Business School which spoke of rampant ‘mis-selling’ in the Indian insurance space.

Even a platform like Jagoinvestor, which claims to have a readership of over 6 Lakh investors, has mentioned commission-free plans all of just once in its 10 year existence. This platform too provides financial ‘education’. It also conducts wellness workshops.

As you can clearly see, the problem is widespread, deep-rooted.

But as an investor or an organization, there are things you could do.

If you are investing in mutual funds

Read up more about ‘Direct plan mutual funds’. With just a tiny bit of effort, you could save yourselves lakhs and crores in the long run. My book, which you can find here, also teaches you how to find a good mutual fund and invest in it.

If you are responsible for your organization’s training needs

Ensure you’re not hiring middlemen. As an employer, you have the privilege and the burden of providing true financial literacy to your people. You are after all, your employee’s primary, and perhaps only source of income. And by hiring middlemen to teach such a critical life-skill, you’ll play into the middlemen’s agenda and do more harm than good.