This CAGR Calculator helps you estimate the Compounded Annual Growth Rate of your investment based on

- Initial value

- Final value &

- Number of years

CAGR Calculator

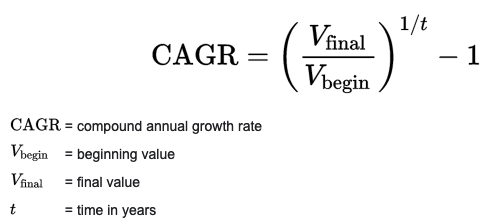

What is the formula used in the CAGR calculator?

The formula used is as below

Examples of CAGR calculator usage

To calculate CAGR returns from an investment

Most investing sites use CAGR for showcasing returns. As an example, say after a 3-year run, your investment of 1,00,000/- in a mutual fund grew to 1,30,000/-

Using the calculator, you can realize that your CAGR return was 9.14%. You can get the 3-year and 5-year returns of mutual funds from this link here.

To calculate how your real estate investment has grown

Say an apartment you purchased in 2008 for 50 Lakhs (50,00,000), is worth 1.6 Crores in 2020. This growth was over a 12 year period.

Using the calculator above, you can see that the CAGR return was 8.29%.

Other Types of Returns Typically Used

There are three basic types of returns you could come across while evaluating investments.

Absolute Return

This is the growth an asset has provided with no relation to time. For example, an investment may have provided you 100% absolute returns, but if that return was only achieved over a period of 20 years, it would still be a poor investment. Therefore, absolute return alone is an incomplete way to judge an investment’s potential.

Annualized Return

This is simply the absolute return over a period of one year. If an investment of Rs. 1000 became Rs. 1150 in one year, your annual return is 15%.

Average Return

An average return is another terrible way to judge investments.

Assume an investment of Rs. 1000 provided you an absolute return of 100% the first year, which means your investment would be worth Rs. 2000. But the following year, it lost 50% of its value, taking the investment’s worth back to Rs. 1000. Technically, you will have received an average return of (100+(-50))/2, which is 25%. Your annualized return, however, is actually zero.

If you’re looking for Reverse CAGR Calculator, you can find one here.

Good luck. And Happy moneyplanting.

Vinod